That means consumers could apply for 5 auto loans within 45 days and it would only count as one inquiry. Newer FICO scores group inquiries of the same type together within a 45-day window. Credit scoring models now have different ways of accounting for this behavior so as not to punish consumers for shopping around. When people are applying for some types of loans, such as mortgages, auto loans, and student loans, they tend to apply for multiple loans so they can shop for the best rates. Hard inquiries can generally hurt your score by a few points because seeking new credit is considered risky behavior. In addition, within these broader categories listed above, the scoring models have different ways of assigning value to certain variables. However, FICO and VantageScore assign slightly different weights to each category, as shown in the following table (percentage values are approximate).

Since the scores share the same general categories, it is safe to assume that they will both be bolstered by the same common sense behaviors that lead to good credit, such as not using too much of your available credit and not missing payments. While VantageScore credit scores are also used by some lenders, they are more well-known for their use as an educational tool.īoth FICO and VantageScore consider the same general categories of information from your credit report (although they use slightly different terms to describe them), which include:

News, FICO scores are used by 90 percent of “top lenders.” The primary difference between VantageScores and FICO scores is what they are used for.įICO scores have been in use for a longer period of time and, consequently, are most widely used by lenders to make lending decisions.

#Vantage credit score range free#

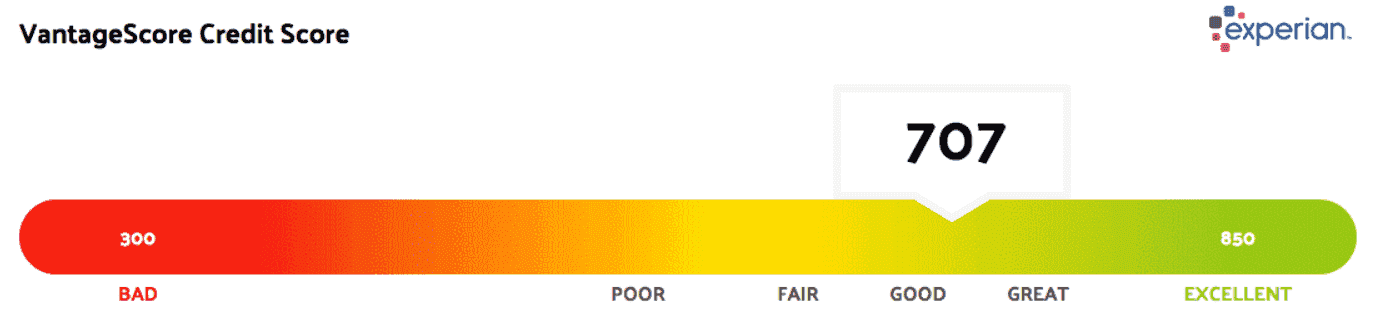

You can view your free VantageScore with TransUnion and Equifax on Credit Karma. Non-financial institutions have also increasingly been adopting VantageScore, such as landlords and utility providers. The largest group of financial institutions that uses VantageScore is credit card issuers. Who Uses VantageScore?Īccording to Experian, VantageScore is used by lenders for all types of loans except mortgages, where FICO is still the dominant player. VantageScore Solutions, LLC has released VantageScore 4.0, which is supposed to be more accurate than previous versions, but since it takes lenders a long time to adopt new credit scoring models, most are still using VantageScore 3.0. The most commonly used version of the VantageScore used by lenders today is the third iteration of the credit scoring model, VantageScore 3.0. VantageScore is a tri-bureau credit score, meaning the exact same model is used at each credit bureau. The VantageScore credit score, which is sometimes referred to as a “Vantage credit score,” is a credit scoring model created in 2006 by the three major credit bureaus (Experian, TransUnion, and Equifax) to compete with FICO’s credit scoring models. So what is a VantageScore credit score and how is it different from a FICO credit score? Is one better than the other? We’ll compare and contrast the two types of credit scores and discuss the merits of each in this article. However, you may not have realized that this credit score is not the same as your FICO score. If you monitor your credit using a free website, chances are, you’ve seen your VantageScore.

0 kommentar(er)

0 kommentar(er)